Understanding the 2025 High-Value Council Tax Surcharge (“Mansion Tax”)

- 15th January 2026

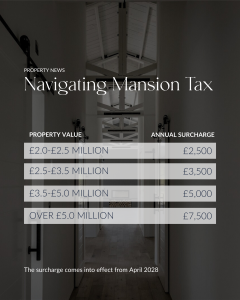

The 2025 Budget introduced a new High-Value Council Tax Surcharge, often referred to as the “mansion tax,” affecting homes valued at £2 million and above in England. For owners of prime properties, this means factoring in an annual surcharge of £2,500–£7,500 depending on the value of your home. While it will not affect the majority of buyers, it is an important consideration for those in the upper-quartile market, influencing ownership costs, investment potential, and long-term planning.

What the Surcharge Means for Prime Homeowners

The surcharge is designed to apply progressively to properties valued above £2 million. For homeowners in this bracket, the annual council tax liability will increase significantly, making it a material factor in the overall cost of maintaining a prime property. While the exact amount depends on local council tax bands and property valuation, the surcharge introduces an additional layer of financial consideration that can affect both individual budgets and wider investment strategies.

It’s important to note that the surcharge applies to the property itself, not the owner. This means that any purchaser or investor in this market segment needs to factor this into their calculations when assessing total holding costs. For owners planning to retain their homes long-term, it may also influence decisions around renovations, extensions, or other investments in the property.

Implications for Investment and Market Activity

Although the surcharge is unlikely to dramatically alter demand for prime properties, it could influence buyer behaviour at the very top end of the market. Some potential buyers may consider alternative locations or adjust budgets to accommodate the additional annual cost. For sellers, understanding this context is crucial, particularly when advising buyers or planning a marketing strategy. Highlighting value beyond tax considerations, such as lifestyle, location, and investment potential, becomes even more important in this environment.

Planning Ahead

For homeowners and potential buyers in the upper quartile, proactive planning is key. Engaging with financial advisors, assessing the long-term impact of the surcharge, and understanding the broader market context are all essential steps. Those selling a high-value property can also use this insight to structure a marketing campaign that addresses these considerations and reassures buyers that their investment is sound.

At Prime&Place, we understand the nuances of the upper-quartile property market. Our approach combines deep local knowledge, data-driven insight, and bespoke marketing to ensure every property is presented to the right audience. In the context of the new surcharge, this means helping clients understand how costs may influence buyer behaviour while highlighting the true value of exceptional homes.

Conclusion

If you own, or are looking to purchase, a prime property in the Midlands or wider England, being aware of the High-Value Council Tax Surcharge is essential. Your local Nock Deighton team would be delighted to share how we navigate these considerations in marketing, demonstrating how strategic presentation and targeted campaigns continue to convert interest into successful sales, even in the context of new ownership costs.